The Cato Institute Is Disemboweling America

Cato delenda est

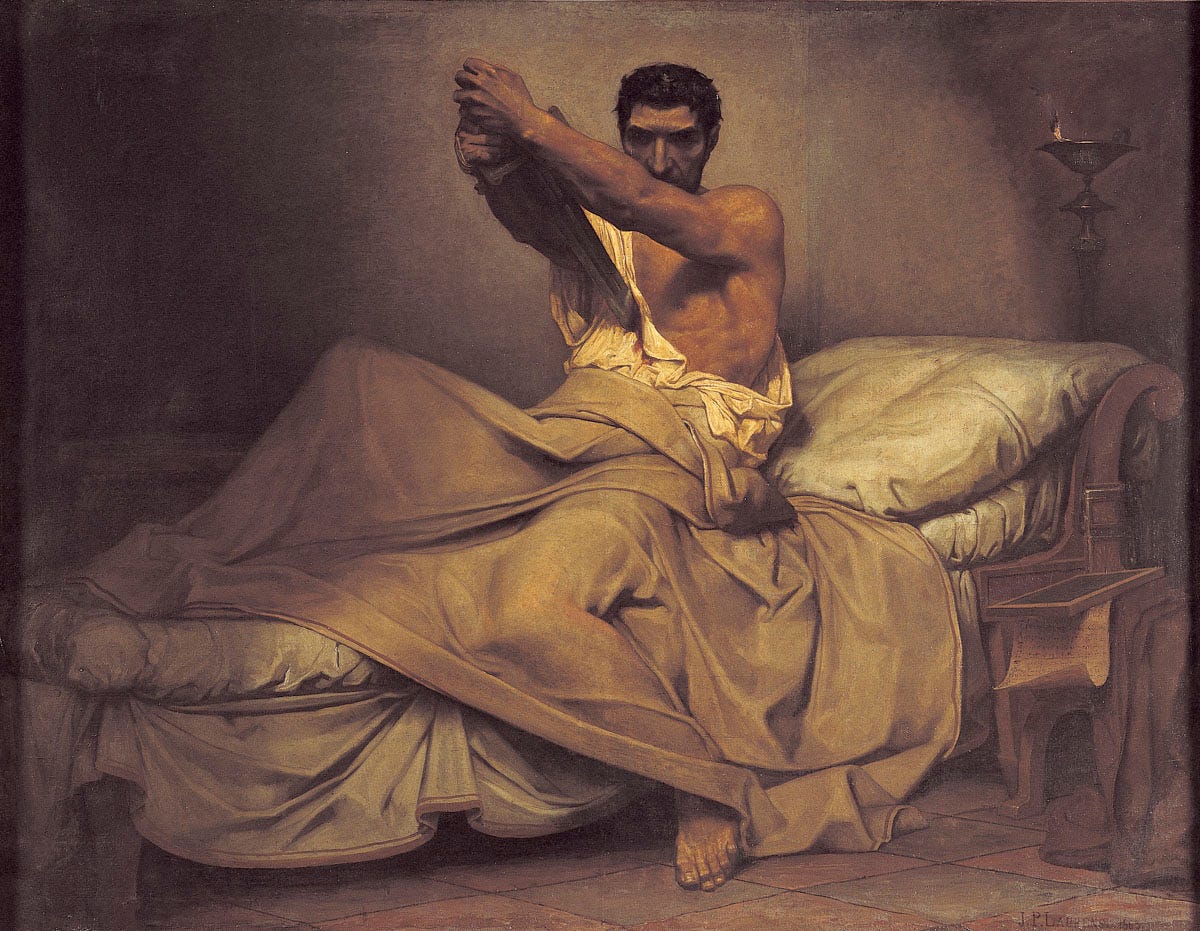

The description of Cato the Younger’s suicide is brutal. He prepares for death with a bath, then dinner with friends, then by reading Plato’s Phaedo, then takes a nap. When he wakes up, he discovers that his sword has been removed from the wall. He calls for it to be brought to him, and when it doesn’t arrive quickly enough, he beats his servant like a dog.

He stabs himself in the stomach, but not deeply enough to die. His son and a doctor rush in and begin stitching the wound. Cato rips out the stitches, tears the wound open with his hands, pulls out his own intestines, and dies.

Like Cato reaching into his own body to tear out his own intestines, the institute that bears his name promotes a gruesome, deliberate national suicide. Through their support for open borders, The Cato Institute is undoing the very sutures that keep the American nation intact. They cloak this radicalism in the language of “liberty,” but it is a hollow, atomized, soulless, liberty that ignores the necessity of a coherent culture.

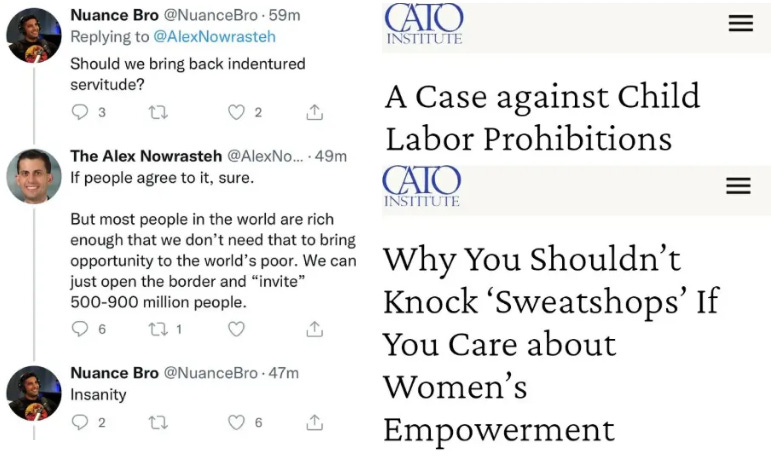

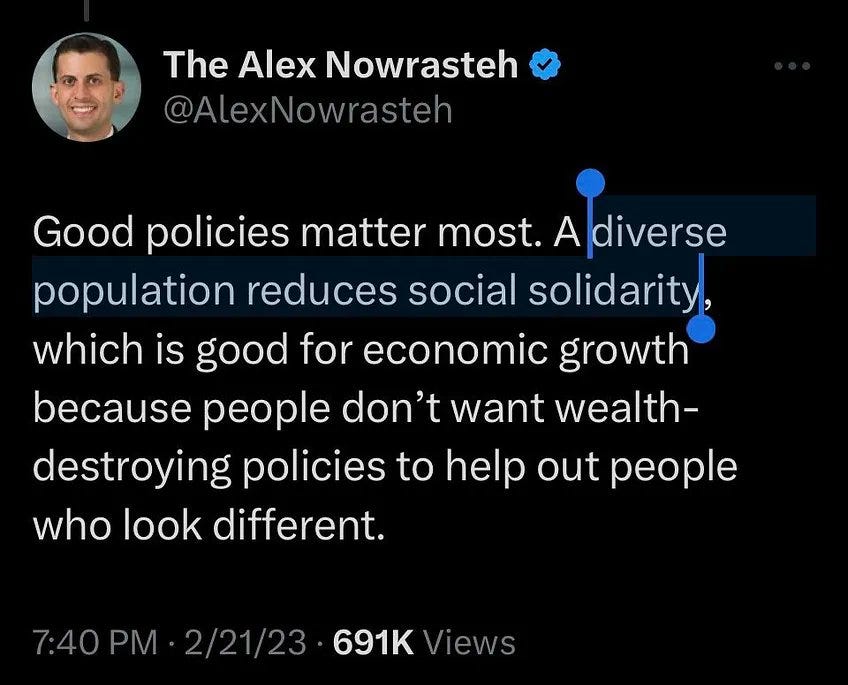

They make their disdain for American culture explicit: Alex Nowrasteh, senior vice president for policy at the Cato Institute, writes that he wants to “reduce social solidarity” in the name of “economic growth.” This is a cold-blooded, sociopathic tradeoff: our social fabric for a few fraudulent points of GDP.

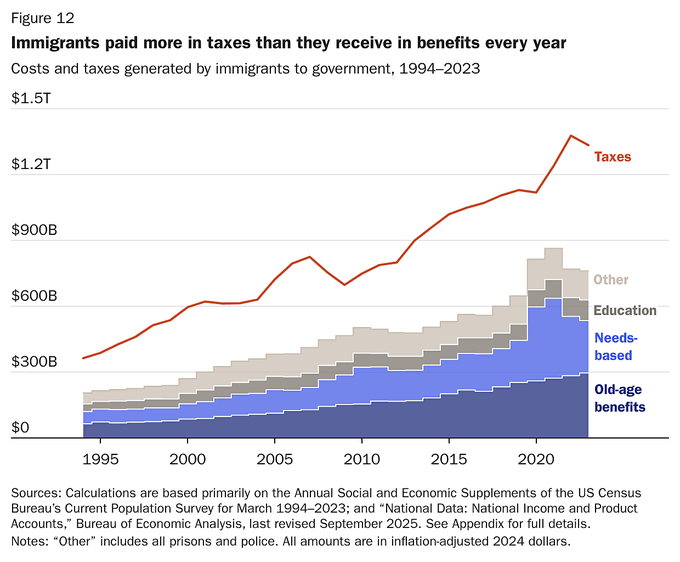

The Cato Institute’s primary vehicle for advancing its agenda is a relentless stream of “empirical” economic studies designed to frame mass immigration—both legal and illegal—as an unambiguous good for the economy. Their latest publication, Immigrants’ Recent Effects on Government Budgets: 1994–2023, is perhaps their most audacious claim to date. Released last week, the study asserts that immigrants contributed a net $14.5 trillion to the U.S. treasury over the last three decades, purportedly narrowing the federal budget deficit by one-third in real terms.

Like most studies produced by the Cato Institute, the analysis rests on a narrow set of assumptions and modeling choices that largely determine the result in advance. By tweaking baselines, time frames, and what costs are included or excluded, the authors can produce almost any number they want while still presenting the work as “rigorous.”

Here are some of the most biased assumptions:

Cato classifies K–12 education as a fixed cost and therefore argues that children of immigrants born in America are free to educate because schools have excess capacity — despite education being one of the costliest and most capacity-constrained government services. Once U.S.-born children of immigrants are included as a cost, Table 13 shows the estimated fiscal benefit drops by roughly 50% (about $6.5 trillion!).

The study does not measure how many illegal immigrants use welfare; instead, it assigns them only a small share (5%) of per-capita welfare costs for programs they are ineligible for. In reality, 61% of illegal immigrant households use welfare.

The paper acknowledges that immigrants’ net fiscal contribution turns negative as they retire and age out of the workforce. But because the analysis is backward-looking (1994–2023), it captures peak working-age years more fully than the later, benefit-heavy retirement years. That weakens any implicit “lifetime surplus” impression readers might draw from the topline results.

If an illegal immigrant goes to the ER and the hospital absorbs the loss (which eventually leads to higher insurance premiums for everyone else), it doesn’t appear in Cato’s “government budget” ledger.

Since Census data doesn’t reliably track legal status, Cato uses “Non-Citizens” as a proxy for illegal immigrants. This bucket includes high-earning H-1B tech workers and legal residents. By averaging these high-earners with undocumented laborers, the fiscal contribution of the “average non-citizen” is pulled upward. It describes those assumptions as “directionally accurate, if imprecise.”

In their allocation table, federal interest on debt ($17.7T) and federal defense spending ($21.1T) are assigned entirely to the US‑born and $0 to immigrants. If the US military protects the land and the economy immigrants are participating in, the idea that they “consume” $0 of that protection is a significant modeling flaw, and that single modeling decision shifts tens of trillions off the immigrant ledger. Cato openly concedes that “the treatment of this spending matters more than any other single assumption.”

Cato classifies infrastructure spending (roads, bridges, highways, and sanitation) similarly to national defense: as a “fixed cost” that does not scale with population. They argue that because a bridge already exists, an immigrant crossing it costs the government nothing. This ignores accelerated depreciation and maintenance costs caused by increased usage. Furthermore, it ignores “lumpy” capital expenditures—when a city’s population grows by 20%, it eventually must build new water treatment plants, expand highways, and increase public transit fleets. By assigning $0 of these long-term capital costs to immigrants, Cato makes the native-born population responsible for 100% of the cost of the physical country the immigrants are utilizing daily.

The “$14.5T” headline is not a measured fiscal surplus. It’s net fiscal flow and a counterfactual add‑on. The paper’s Table 1 splits the result into net fiscal flow ($10.6T) plus “interest saved” ($3.9T) to reach $14.5T. Treating a modeled counterfactual (“interest saved”) like cash flow is a framing move, not standard budget accounting.

The paper focuses on “benefits received” but excludes administrative and enforcement costs induced by the presence of a large illegal population. The multi-billion-dollar annual budgets for ICE, CBP, and the immigration court system are “induced costs”—spending that would not exist if the population were not there—and should be attributed to illegal immigrants.

Cato accounts for remittances only by subtracting a flat $1,250 (1994 dollars, inflation-adjusted) from immigrants’ income and assumes that amount is remitted abroad, shrinking the base they use to estimate excise/sales-type consumption taxes. This is too low. Research indicates that undocumented migrants frequently remit 15% to 45% of their post-tax earnings. By ignoring this outflow, Cato effectively “double-counts” billions of dollars as domestic consumption that never actually enters the U.S. retail market or state sales tax coffers. Notably, Cato itself has used a much bigger remittance adjustment elsewhere: its 2023 fiscal-impact model includes scenarios that reduce immigrants’ consumption/sales taxes by 20% to reflect remittances.

We can guess that inverting all of these rosy assumptions leads to a dramatically different conclusion. Just guesswork, true, but that’s not much different from their methodology.

The study’s most cynical maneuver, however, is buried in its housing data.

The model counts roughly $1 trillion using the following logic:

“The percent of property values from immigration that has come from immigration was then multiplied by residential property tax revenue attributed to the US-born in the NASEM–Cato model. In this way, we estimate the property taxes paid by the US-born population that are the indirect result of immigration-generated higher property values.”

In plain terms, immigrants are assumed to inflate housing prices, and existing homeowners are assumed to pay higher property taxes as a result. Immigrants did not pay those higher property tax; existing residents did, but the model nevertheless credits those tax payments to immigration. This is an extraordinary admission for a libertarian think tank: higher property taxes are framed as a virtue, and the harder it becomes for ordinary people to afford housing due to immigration, the better immigrants are made to look.

I spoke with David Bier, Director of Immigration Studies at the Cato Institute, and the author of this study, about these biased housing assumptions.

He told me: “What’s the criticism exactly? Does the immigrants’ effect on property values increase property tax revenues or not?”

I responded: “Existing owners and renters paying more is a transfer from heritage Americans, not immigrants “saving” anyone.”

He did not respond.

I was once hired at Cato to be part of a "climate change" red team. But was fired right as I was supposed to begin, because they 'discovered' my public statements against "same sex marriage."

Who funds CATO? Follow the money.